Chapter 7 - Bankruptcy Basics for Beginners

Table of ContentsUnknown Facts About Tulsa Debt Relief AttorneyHow Tulsa Bankruptcy Consultation can Save You Time, Stress, and Money.Rumored Buzz on Chapter 13 Bankruptcy Lawyer TulsaThe Buzz on Bankruptcy Attorney Near Me TulsaNot known Factual Statements About Bankruptcy Attorney Tulsa Excitement About Chapter 7 Vs Chapter 13 BankruptcyThe smart Trick of Tulsa Ok Bankruptcy Specialist That Nobody is Discussing

Advertisement As an everyday consumer, you have two major phases of personal bankruptcy to select from: Phase 7 and Phase 13. We very recommend you initial collect all your monetary documents and seek advice from with a lawyer to comprehend which one is finest for your circumstance.The clock starts on the filing day of your previous situation. If the courts dismiss your bankruptcy proceeding without bias (definition without uncertainty of fraud), you can refile quickly or submit a movement for reconsideration. If a judge rejected your instance with prejudice or you voluntarily disregarded the situation, you'll have to wait 180 days prior to filing again.

Jennifer is likewise the author of "Grow! ... Affordably: Your Month-to-Month Guide to Living Your Finest Life Without Damaging the Bank." Guide provides recommendations, pointers, and financial monitoring lessons geared toward helping the reader emphasize strengths, recognize mistakes, and take control of their financial resources. Jennifer's essential monetary advice to her buddies is to constantly have a reserve.

All financial obligations are not created equal. Some financial debts acquire favored condition through the legislation financial obligations like tax obligations or child support. Some financial obligations are a concern based on who is owed the financial debt. You might feel much more obligated to pay a family participant you owe cash to or to pay the medical professional that brought you back to wellness.

Some Known Factual Statements About Affordable Bankruptcy Lawyer Tulsa

And because of this several individuals will inform me that they do not want to include specific financial debts in their bankruptcy instance. It is completely reasonable, yet there are two issues with this.

Also though you may have the best intentions on paying off a specific financial obligation after bankruptcy, life happens. The circumstances of life have led you to bankruptcy since you could not pay your financial obligations.

Most often I see this in the clinical area. If you owe a doctor cash and the financial debt is released in insolvency, do not be amazed when that physician will no longer have you as a patient.

Which Type Of Bankruptcy Should You File - An Overview

If you owe your household money prior to your case is filed, and you hurry and pay them off and afterwards expect to file personal bankruptcy you ought to additionally expect that the insolvency court will certainly get to out to your household and attempt and get that refund. And by shot I indicate they will certainly sue them and make them go back to the cash (that will not make points uncomfortable in all!) so that it can be dispersed among every one of your lenders.

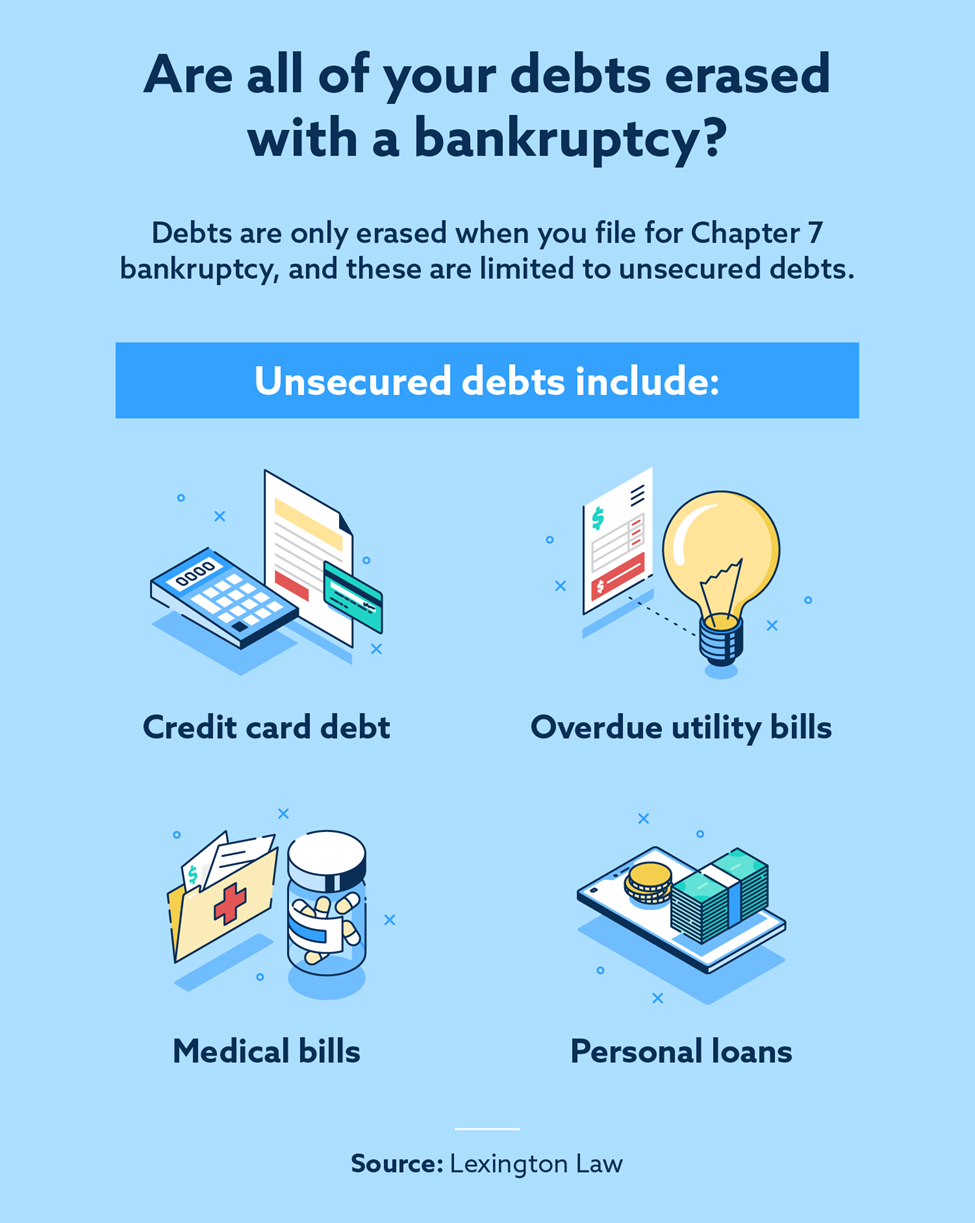

There are court filing charges and many individuals employ a lawyer to browse the intricate process. You need to make certain that you can manage these expenses or check out choices for cost waivers if you certify. Not all debts are dischargeable in bankruptcy, so before filing, it is essential that you clearly understand which of your debts will certainly be released and which will remain.

There are court filing charges and many individuals employ a lawyer to browse the intricate process. You need to make certain that you can manage these expenses or check out choices for cost waivers if you certify. Not all debts are dischargeable in bankruptcy, so before filing, it is essential that you clearly understand which of your debts will certainly be released and which will remain.

Fascination About Tulsa Bankruptcy Legal Services

If you're wed or in a residential collaboration, your insolvency declaring could also impact your companion's finances, especially if you have joint financial obligations or shared possessions. Talk about the ramifications with your partner and consider inquiring on just how to shield their economic rate of interests. Insolvency should be deemed a last option, as the impact on your funds can be my link considerable and resilient.

So before you make a choice, ask yourself these inquiries and consider your other alternatives. That method, you're better prepared to make an educated decision. Angelica Leicht is senior editor for Managing Your Money, where she creates and edits articles on a series of individual money topics. Angelica formerly held editing functions at The Simple Dollar, Passion, HousingWire and other financial magazines.

A number of researches recommend that medical financial debt is a considerable cause of many of the insolvencies in America. If you have excessive financial obligation, bankruptcy is a federal court process created to assist you remove your financial debts or settle them under the defense of the personal bankruptcy court.

Tulsa Bankruptcy Filing Assistance Fundamentals Explained

Attempts to regulate your spending have fallen short, also after going to a credit score counselor or trying to stick to a financial debt combination plan. Your efforts to work with financial institutions to establish up a financial obligation repayment strategy have not functioned.

Attempts to regulate your spending have fallen short, also after going to a credit score counselor or trying to stick to a financial debt combination plan. Your efforts to work with financial institutions to establish up a financial obligation repayment strategy have not functioned.There are court filing charges and lots of people hire a lawyer to navigate the intricate procedure. Because of this, you require to make sure that you can afford these expenses or explore alternatives for fee waivers if you certify. Not all financial obligations are dischargeable in personal bankruptcy, so before declaring, it is necessary that you plainly understand which of your financial debts will be discharged and which will certainly stay.

The 20-Second Trick For Tulsa Ok Bankruptcy Specialist

If you're wed or in a residential partnership, your personal bankruptcy filing might likewise impact your partner's funds, specifically if you have joint financial debts or shared possessions. Review the effects with your companion and take into consideration inquiring on exactly how to safeguard their financial rate of interests. Bankruptcy should be deemed a last option, as the influence on your financial resources can be significant and resilient.

So prior to you decide, ask yourself these concerns and consider your various other alternatives. In this way, you're much better prepared to make an educated choice. Angelica Leicht is elderly editor for Handling Your Money, where she creates and edits short articles on a variety of personal money site web topics. Angelica previously held editing duties at The Easy Buck, Rate Of Interest, HousingWire and various other financial magazines.

How Bankruptcy Law Firm Tulsa Ok can Save You Time, Stress, and Money.

In 2017, there were 767,721 personal insolvency filingsdown from the 1.5 million submitted in 2010. A number of studies suggest that medical debt is a considerable cause of most of the bankruptcies in America. Insolvency is designed for people caught in serious financial circumstances. If you have excessive debt, bankruptcy is a federal court procedure made to aid you eliminate your financial obligations or repay them under the security of the bankruptcy court.

The meaning of a borrower who may file bankruptcy can be located in the Personal bankruptcy Code. Efforts to manage your costs have actually stopped working, even after seeing a credit rating counselor or trying to adhere to a debt consolidation strategy. You are incapable to fulfill debt commitments on your current income. Your attempts to deal with lenders to set up a financial obligation settlement strategy have actually not functioned.

Comments on “The Basic Principles Of Bankruptcy Lawyer Tulsa”